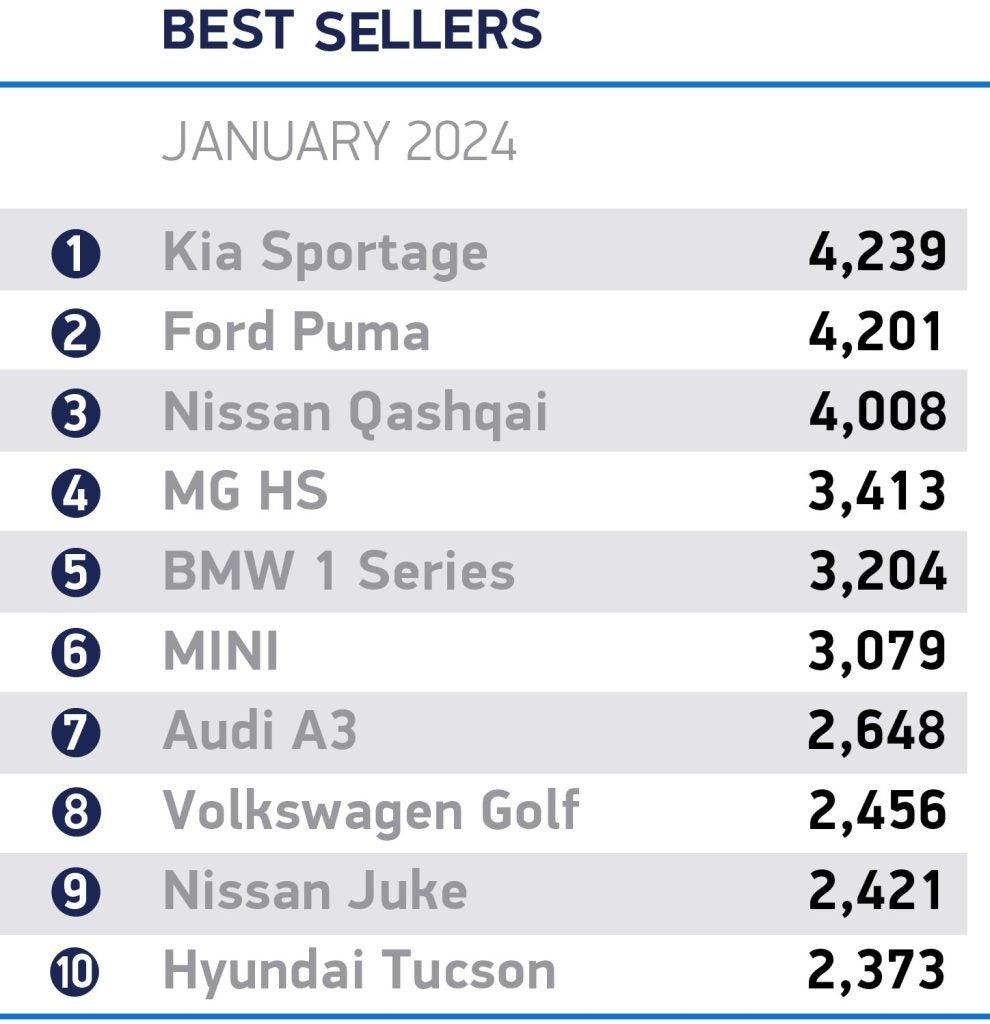

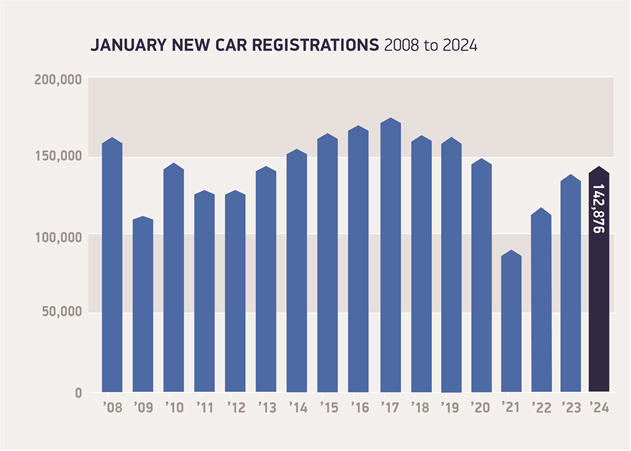

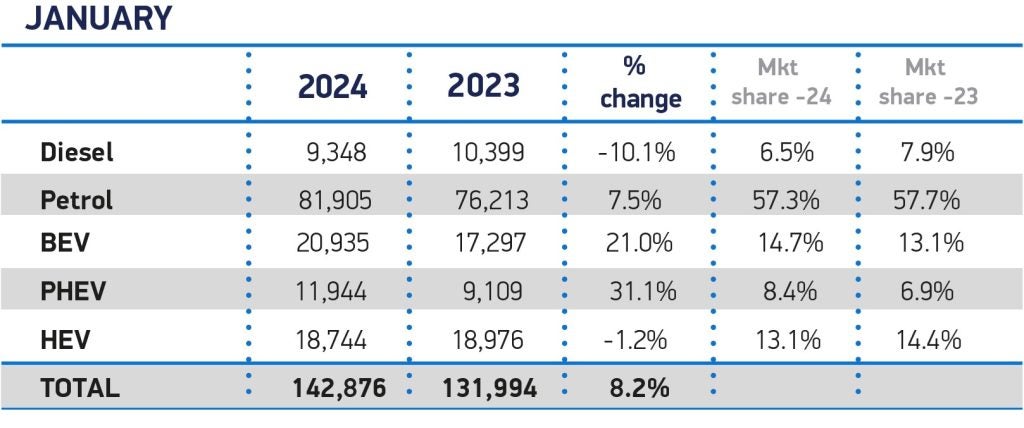

January saw 142,876 new cars registered in the UK, some 8.2% up on January 2023 and the 18th consecutive month of growth.

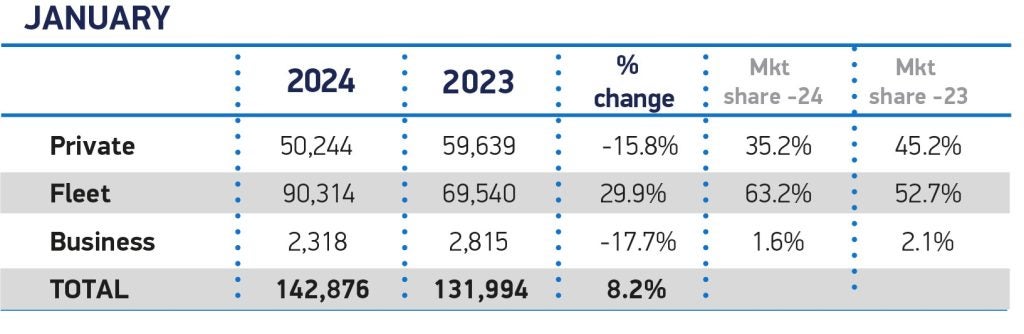

The increase was driven entirely by the fleet market, which rose by 29.9%, while private retail sales fell 15.8%. Fleets accounted for more than six in 10 (63.2%) new cars registered, up from just over half (52.7%) last year.

The UK’s car market also – narrowly – reached its anticipated milestone of a million BEV registrations since records began. Some 20,935 BEVs were registered in January, a rise of 21.0% year on year, taking the overall total since 2002 to 1,001,677.

BEV market share for January also grew year on year to 14.7%, although this is below the full 2023 performance of 16.5%. Plug-in hybrids (PHEVs) recorded volume growth of 31.1% to take 8.4% of the market, while hybrid (HEV) volumes fell -1.2% with a 13.1% share.

Volatility in BEV supply has been expected and is likely to continue as manufacturers adjust product allocation following the last-minute resolution over UK-EU rules of origin, which had threatened to apply tariffs to EVs, restricting affordability. However, while fleet and business demand for BEVs grew by 41.7% in January, registrations by private buyers fell by 25.1%. The UK’s trade association, the SMMT, said that ongoing trend that will undermine Britain’s ability to deliver net zero.

Mike Hawes, SMMT Chief Executive, said: “It’s taken just over 20 years to reach our million EV milestone – but with the right policies, we can double down on that success in just another two. Market growth is currently dependent on businesses and fleets. Government must therefore use the upcoming Budget to support private EV buyers, temporarily halving VAT to cut carbon, drive economic growth and help everyone make the switch. Manufacturers have been asked to supply the vehicles, we now ask government to help consumers buy the vehicles on which net zero depends.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataRichard Peberdy, UK Head of Automotive for KPMG, said the industry faces a challenging environment. “Household budgets continue to be squeezed, and the cost of car finance remains elevated,” he said. “This remains a challenging environment for growing consumer new car sales volumes, but good supply of new vehicles, and discounting of many models, is helping car dealers to keep volumes flowing.

“This economic landscape is also leading more people to look towards the used market – which has grown its stock levels after the pandemic years of shortage. The evolving used electric vehicle market is also providing more options for those consumers looking to transition to an EV – some of whom will have been deterred from buying a new EV due to the scale of price depreciation that has been witnessed.

“With the Zero Emission Vehicle Mandate having begun, the pressure on manufacturers to increase new EV sales has increased. It’s not surprising to see a ramping up of calls from within the automotive industry for government to again look at grant incentivisation for consumers making the switch to an EV, plus a reduction in the level of VAT being paid when using public charge points.”