General Motors (GM) recently finalised a significant battery material supply contract worth $19 billion with South Korea’s LG Chem, marking a major milestone in the electric vehicle (EV) industry. Under the agreement, LG Chem will supply cathode active materials until 2035, sufficient to power up to 5m cars produced by GM.

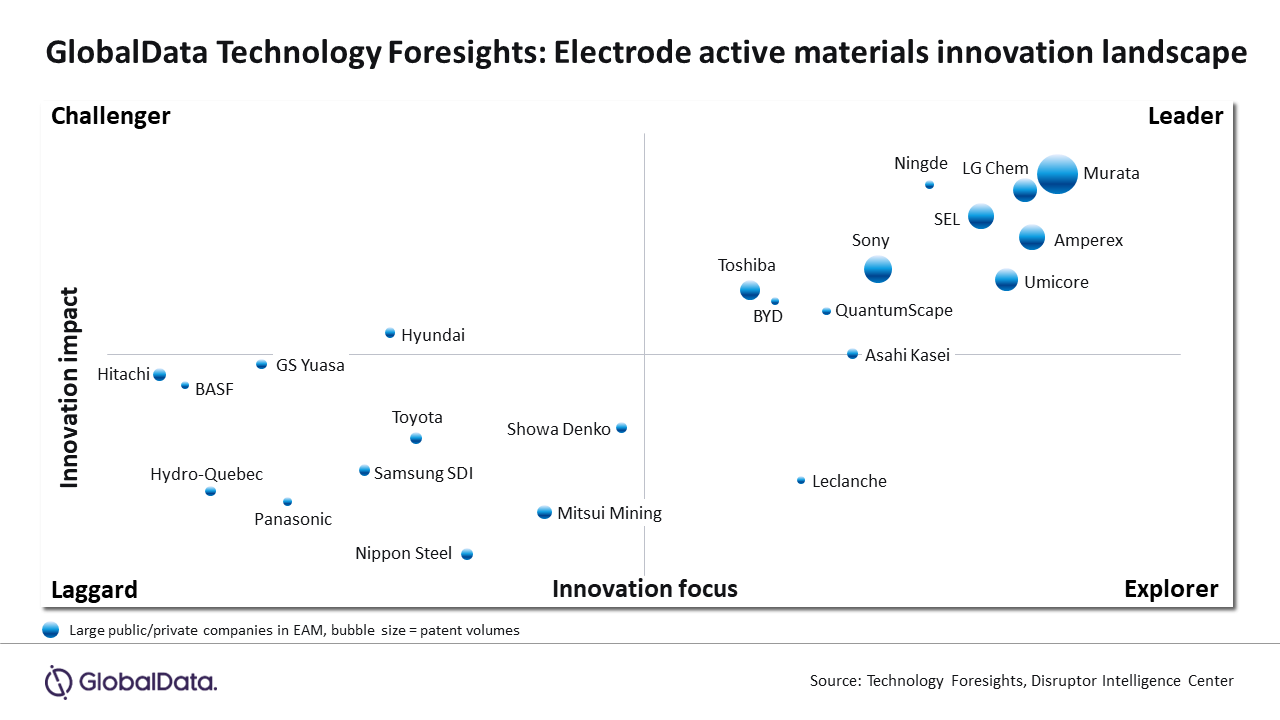

This collaboration exemplifies the substantial commercial value that high value innovators in electrode active materials have been achieving in recent times, as highlighted by Technology Foresights, a proprietary framework developed by GlobalData.

The significance of cathode active materials, and more broadly, electrode active materials, cannot be overstated in the realm of high performance EV batteries. Nickel, magnesium, and other metals constitute the active materials, playing a pivotal role in the electrochemical reactions throughout the charging and discharging processes. The increasing adoption of EVs over the past decade has fuelled a heightened need for electrode materials that exhibit superior efficiency and extended lifespan.

Sourabh Nyalkalkar, Practice Head of Innovation Products at GlobalData, said: “Within the landscape of EV technologies, there has been a steady growth in innovation pertaining to electrode active materials. Notably, the landscape of innovation in this domain is primarily shaped by prominent corporations in Southeast Asia, dominated by companies with heavy R&D investments in advanced materials and specialty chemicals manufacturing.

“An interesting observation from the innovation leadership map on the Technology Foresights platform is the strategic efforts made by a few automotive giants, including Toyota, Hyundai, and BYD. These companies are internally enhancing their capabilities for the development of electrode materials and various other components crucial to battery technology.”

LG Chem’s leadership in over 30 innovations related to EV and battery technology solidifies its position as a key collaborator for EV manufacturers. However, the Technology Foresights platform highlights numerous other significant players who are also establishing partnerships with automotive companies to supply electrode active materials for their EV product lines. For example, Umicore formed a joint venture with PowerCo, a unit of Volkswagen, in October 2023 to supply sustainable cathode electrode materials in Europe. Toshiba, another major player in this field, secured an agreement with EVage to provide electrode active materials for lithium-ion batteries, powering up to 10,000 EV vans. Also, Sony, having previously sold its battery technology assets to Murata Manufacturing, is now collaborating with Honda Motors to develop EV charging infrastructure.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSourabh added: “In recent years, global automotive companies have formed several significant partnerships with key suppliers of EV components. The increasing pace of innovation indicates a rising level of competition, providing automotive manufacturers with a constant stream of advanced options to consider. This trend also serves as a signal for startups in the industry, such as StoreDot, A123, Honeycomb Energy (a spin-off from Great Wall Motors), and others, to seize the opportunities that arise and meet the challenges presented by the evolving landscape.”