The COP28 circus in Dubai has finished. It was quite a gathering. Some 75,000 people attended and there were a lot of words written and broadcast in the media. Has it achieved much? People will continue to discuss and argue of course. Besides the data and the severity of the climate crisis humanity faces, arguments will rage about what actions make the most sense – and who needs to step up, pay for it – and how urgent things really are.

Much is being made of the language in an agreed final text. It was agreed by 198 countries, so some softening was perhaps inevitable, but it does – for the first time – point to the role of fossil fuels in the global warming crisis. It calls on nations to ‘transition’ away from them, but doesn’t go as far as calling for them to be phased out. There’s a big discussion to be had about the cost of such a transition and how poorer countries can be helped with that.

On the plus side, there are commitments being made and the direction of travel is there on renewable energy sources displacing fossil fuel sources – even if it can’t happen immediately. Also, technology and scale economies are making renewable solutions cheaper – over time – than oil and gas. The hope has to be that the laws of basic economics will move the dial towards more renewables as they become cheaper to deploy.

What was there in the COP28 process for companies to take away? Well, given that the event is framed around the politics and actions (voluntary) needed at nation-state level across the globe, companies are subsidiary to what the national politicians are striving to achieve. However, in national – or trade bloc – contexts, they are going to be major actors that are part of national commitments to lower aggregate carbon emissions on long-term stated pathways to net zero.

It is important to note, of course, that transport is also a very important part of the greenhouse gases mix.

Oil – long the most valuable commodity market in the world – is expected to decline largely because of booming electric vehicle sales worldwide.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTransportation is responsible for around 60% of world oil demand, while road transport alone accounts for a massive 15% of global energy-related emissions. EVs are now widely seen as the key means of decarbonising this sector.

EV sales have boomed over the last few years, with the IEA anticipating 18% EV sales in the global car market in 2023. The growth in EVs means that the IEA now expects EVs to erase five million barrels per day of world oil demand by 2030.

Vehicles in use – passenger cars and commercial vehicles – emit huge quantities of greenhouse gases. The transition from petrol and diesel to more electric is a big lever for governments. Not only that, but there are also large CO2 emissions expended in vehicle manufacturing. There is a lot that can happen there in terms of incentives for investment in renewables at manufacturing facilities to lower CO2 footprints in manufacturing operations.

EV’s ‘on track’ for net zero by 2050

Ahead of COP28, EVs were one of just three sectors – along with solar power and lighting – that the IEA assessed to be “on track” for net zero by mid-century. GlobalData expects global EV sales to hit 51.6 million in 2035.

Sales of EVs in China have soared in recent years, representing around a quarter of the market. In the US, the Inflation Reduction Act (IRA) has attracted $100bn in new investment announcements in EV and battery manufacturing, as well as in battery components and recycling.

But unlike solar PV – whose cheapness and distributed nature make it an attractive investment prospect the world over – EVs have made little impact in emerging markets and developing economies, due to the relatively high purchase price of an EV, and a lack of available charging infrastructure.

This has not gone unnoticed by some of the world’s national climate leaders, who have launched a new Global Zero Emission Vehicles (ZEV) Transition Roadmap, as part of the COP28 ‘Breakthrough Agenda’. The Breakthrough Agenda is an internationally-recognised and annual COP-centred process, launched two years ago at COP26. Backed by 56 countries, its goal is to boost international cooperation on decarbonisation this decade in certain high-emitting sectors, including transport.

Among several new collaborative programmes launched by the Breakthrough Agenda at COP28, the ZEV Transition Roadmap presents a holistic framework that articulates how wealthy governments intend to strengthen support for EVs in emerging markets and developing economies, with the ambition of making EVs the “most affordable, accessible, and attractive option in all regions by 2030”.

Led by the Zero Emissions Vehicles Transition Council (ZETC) – which is comprised of 17 territories including the UK, US, Canada and South Korea – the roadmap calls for improved access to and a scaling-up of financing for EVs; accelerated charging infrastructure roll-out; lifecycle management of vehicle batteries and components; and further technical support for emerging markets and developing economies.

It is a big ask and there are sometimes pathways to solutions that lower CO2 that are less obvious than EVs – such as through the use of biofuels in Brazil. There is a long history of ethanol fuel – sourced from sugarcane – to power vehicles in Brazil. Since flex-fuel was launched, ethanol use has prevented 630 million tonnes of CO₂ equivalent being released into the atmosphere, according to UNICA, the Brazilian Sugarcane Industry and Bioenergy Association. The presence of biofuels in the transport sector – as well as the fact that Brazil generates 80% of its electricity from hydroelectric plants – means that Brazil has one of the cleanest energy mixes in the world, with 50% renewable energy consumption (and 32% of renewable energy from biofuels). There are competing use cases for biofuels and EVs may be the way to go long-term, but biofuels can play a role – particularly given EV infrastructure issues in developing countries.

Some car companies in Europe are also talking up synthetic fuels that can be used by internal combustion engines (ICEs) as a potential sustainability solution – though it is only every likely to be a small part of the picture. When it comes to heavy-duty vehicles, biofuels can play a significant role and there is plenty of interest in hydrogen, too.

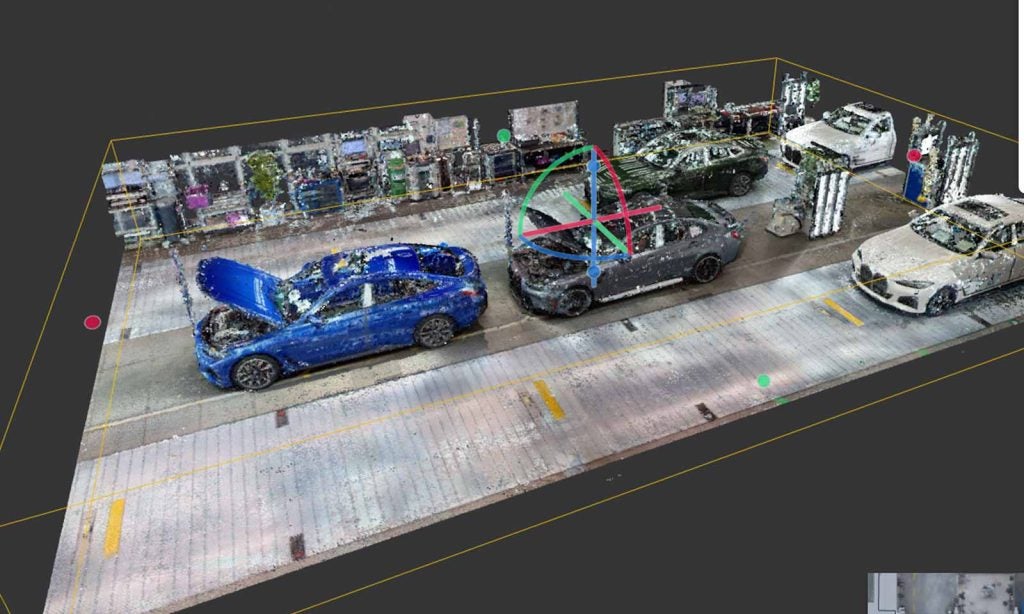

For companies themselves across the global autos sector, it’s very much a case of continuing to do what they have been doing to reap the cost benefits of renewables in energy use, more sustainability in materials use (especially circular economy gains), optimised logistics and constantly reviewing their own progress on pathways to lower CO2 and ultimately net carbon zero goals. For the big multi-nationals, they must consider operations across national borders and ensuring carbon footprints are as low as they can possibly be, given the constraints that are imposed – both from local operational imperatives and national political frameworks.

At COP29, in Azerbaijan in 2024, we will hear much more on all of this, of course. By then, we’ll have more data to help us, in terms of the scale of the macro problem and the contribution of different sectors to alleviating it and on what timescales. The auto industry and its companies are, at least, at the forefront of the challenging transition away from fossil fuels.