Any round-up of the year focusing on ‘winners’ is bound to be somewhat subjective. Grouping everything into good and bad, winners and losers, in a binary manner is necessarily simplistic and ignores the more complex dynamics of variable performance and behaviour. That is especially true of a complex industry like automotive. Nevertheless, in looking back at a whole calendar year, through the prism of news coverage on Just Auto, there are inevitably some standout items – in a positive sense. Time means we cannot mention everything and we’ll steer clear of the negatives and ‘losers’. Caveats out of the way, this run-down is of course selective.

National markets and industries

The year 2023 saw a general volume bounce-back from the chips crisis and supply constrained situation of 2022. Manufacturers were generally able to better supply the market with new product across the world, as the year progressed. Not only that, but they had learned how to adjust product mix and transaction prices to get the best margins. That modus operandi meant higher top lines feeding into plump profits – for OEMs and suppliers, even as shortages eased. Two of the biggest national markets for the industry stand out as particularly positive in 2023: the US and China.

The US market was propelled by a stronger than expected economy. Indeed, it wasn’t until November that we saw signs of demand growth easing and incentives starting to be offered. However, transaction prices are still high.

China was a different bag, but still a positive one. The economy was a more mixed picture and there were serious concerns in 2023 – about the stressed property sector and trade outlook – but Beijing tends to make sure the automotive ‘pillar’ industry is okay. Following the market’s weak performance in early 2023, the Chinese government introduced a series of macro measures to stabilise economic growth and promote automobile consumption. The vehicle market in China was dominated by price cuts (it started with Tesla and rapidly proliferated to the domestic OEMs and went beyond EVs) and also an extension of tax cut incentives on New Energy Vehicles (NEVs). In November, consumers rushed to take advantage of heavy discounts and aggressive incentives offered by OEMs and dealerships.

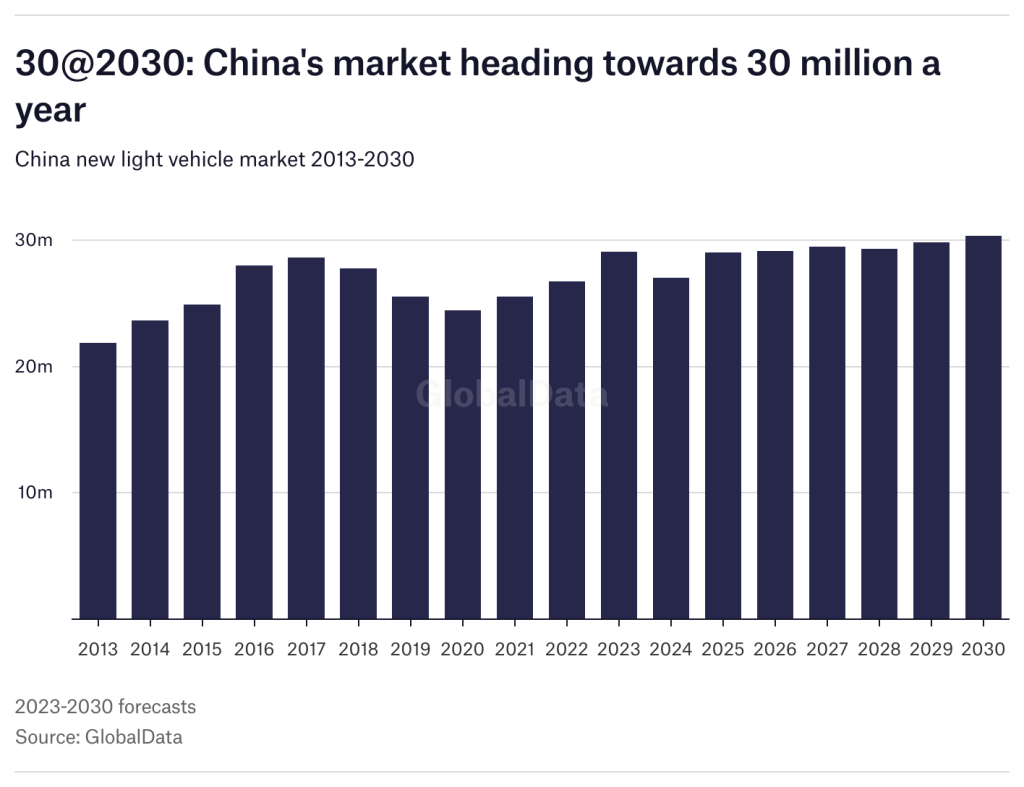

Looking ahead, however, the sustainability of the price war and a slowing economy in China are concerns. There is only so much ‘pull-forward’ a market can take. However, China’s market is on track to hit 30 million units a year by 2030. Fingers crossed there are no major geo-political upsets ahead in East Asia that would upturn that positive scenario.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Two other standout national positives also come from Asia.

In southeast Asia, Thailand’s vehicle market has been contracting as demand for 1-ton Pickups runs out of steam. However, the country’s automotive industry is seeing plenty of investment. In particular, the recent entry of Chinese EV giants has shifted Thailand’s automotive landscape.

Also, India’s market was notable for its resilience during the course of 2023. The Indian market has continued to surprise on the upside. In October, monthly light vehicle wholesales reached an unparalleled 449,000 units. Sales were up by 7% month-on-month over the previous month’s peak and by 16% year-on-year: India: breaking all records.

Companies and models

We’re not going to look at financial or sales metrics here and crunch the numbers (we’ll leave that till the full 2023 numbers are in). This is about the companies that we felt stood out from the crowd. First up has to be BYD. Attaining a twelve percent share of its home market during September was quite the achievement (VW: ten percent and Toyota eight percent). And yet not too long ago, the company’s decision to end production of IC-only models seemed unnecessarily risky. Instead, it seems to have been a masterstroke as buyers continue to leap on BYD brand hybrids, PHEVs and EVs. According to the firm’s own data, deliveries for the first nine months exceeded two million units. Growth over the previous year is around 80%. There are ambitious plans for exports, too.

BYD overtakes VW in China – what happens next?

We also feel Toyota deserves a mention. Not so long ago, there was criticism that the carmaker relied too heavily on its strength in hybrids but was late on BEVs. It addressed that, but also retained its strong position in hybrids. As concerns over the short-term outlook for BEVs in major markets (charging infrastructure, lack of consumer enthusiasm) grew in 2023, it started to look like Toyota was actually well placed with all those hybrid models. Sales of hybrids jumped 41% to 888,000 vehicles in the quarter to the end of September.

SAIC’s MG brand was also a star performer in Europe this year (especially the UK market, where the brand has a certain resonance). In terms of volume, MG is already outperforming established brands such as Suzuki, Mazda, and Mini. New models such as the MG 4 have hit the spot with consumers and racked up good reviews in the motoring press.

Other companies, brands and people that impressed us this year:

- Cupra – Born to (out)run – Cupra leaves SEAT standing

- Ford in Europe – Ford Puma ST Powershift – UK’s No.1 now even better

- HMG’s Genesis – Silencing the doubters? Genesis doubles UK sales

- VinFast – a bonkers IPO, but that in itself was quite an achievement

- Nikola – Nikola CEO Steve Girsky: “The hydrogen highway is on its way”

- Stellantis – strategy and talk of the low-priced e-C3

- Polestar – Polestar 2 – the FWD car that went RWD

- BMW – Visionary Neue Klasse

- Kia – Still progressing and doing well

- Renault Kangoo – it was always quietly cool

- Renault Ampere – Luca de Meo is certainly a busy and highly capable chap. We also liked the name and logo.

- Aston Martin – quite the tech deal with Lucid and attracting Saudi investment (not to mention that NYC shop)

- Qualcomm – its electronics quickly getting significant presence in automotive industry

- Magna – the old ‘Tier 0.5’ still very much walking the major supplier walk

- Shawn Fain – the UAW chief cleverly played the Detroit 3 in the contract negotiations

- StoreDot – StoreDot’s fast-charging batteries ‘on track’ for 2024 production

- Inceptio Technology – the Chinese developer of autonomous driving technologies for heavy-duty trucks

- Skoda – more adventurous with corporate strategy than people think: Skoda SKD assembly in Kazakhstan to start in Q1

- Tesla Superchargers – While all eyes may be on Tesla’s Cybertruck (jury most definitely still out), it is worth mentioning that this year a string of automakers have moved to adopt NACS, following the surprise announcement by Ford.

- The Vatican City goes green – Technically, a whole nation goes fully BEV reliably way sooner than anyone else. This year the world’s smallest state announced it had signed an agreement with Volkswagen to gradually replace its entire fleet with electric vehicles by 2030. First deliveries are expected to start in 2024. Kudos to VW for doing a deal that has more symbolic significance than most. What about the ‘pope-mobile’ though?