In the wake of Tesla’s latest quarterly results, the company’s share price took another slide. Sales and profits disappointed investors again, but so did the outlook – which is for growth of Tesla sales to moderate in 2024.

The gloomier investor and analyst sentiment around Tesla is understandable right now. However, there is a need for a broader perspective when assessing how the company has been performing and where it stands. The problem is perhaps more with unrealistic expectations.

Tesla’s achievements – in overall automotive industry terms – are still pretty remarkable. It has come out of nowhere to be a leading player as a global vehicle manufacturer with a market cap valuation (still) way in excess of the established players. On the share price, a correction was always on the cards at some point when the market realised there are limitations to Tesla’s growth and that a dynamic industry will pose new challenges for the company. Tesla is not, after all, immune to the challenges faced by all in a sector under considerable pressure.

Tesla, though, is indisputably a leader in BEVs and has secured something of a first mover advantage with its winning designs and clever brand messaging – just as electric vehicle demand began to significantly grow in the 2020s. The established OEMs were ‘caught napping’ as one analyst put it, happy with the relatively easy returns from tried and tested ICE-based products sold on the traditional OEM-dealer-customer trading model. Tesla has shaken things up, especially in the US.

Making cars though, is no easy business – just ask the companies who have been doing high volume automobiles for many decades. Newcomers can rightly claim to approach the industry with fresh eyes that can see potential for improvement on the inertia of the ‘old ways’, but creating the right manufacturing processes and supply chains from a standing start is particularly challenging.

“Ramping up volume has certainly not been a seamless exercise for Tesla.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free sample

Company Profile – free sampleThank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Ramping up volume from a standing start has certainly not been a seamless exercise for Tesla. There have been quality concerns and suspicions that parts failures (suspension parts, in particular) on Tesla models have not been addressed as well as consumers would like. The gull-wing doors on the Model X looked to industry veterans like unnecessary over-engineering (Tesla sues German supplier over saggy falcon wing doors).

Nevertheless, Tesla has enjoyed considerable market success as it has added models and production capacity, most notably with a plant in Shanghai to serve the world’s largest market.

Yes, there were problems in Shanghai to start with. The plant has been hit by Covid-related disruption to its operations caused by Beijing’s somewhat chaotic public health policies during and after the Covid pandemic.

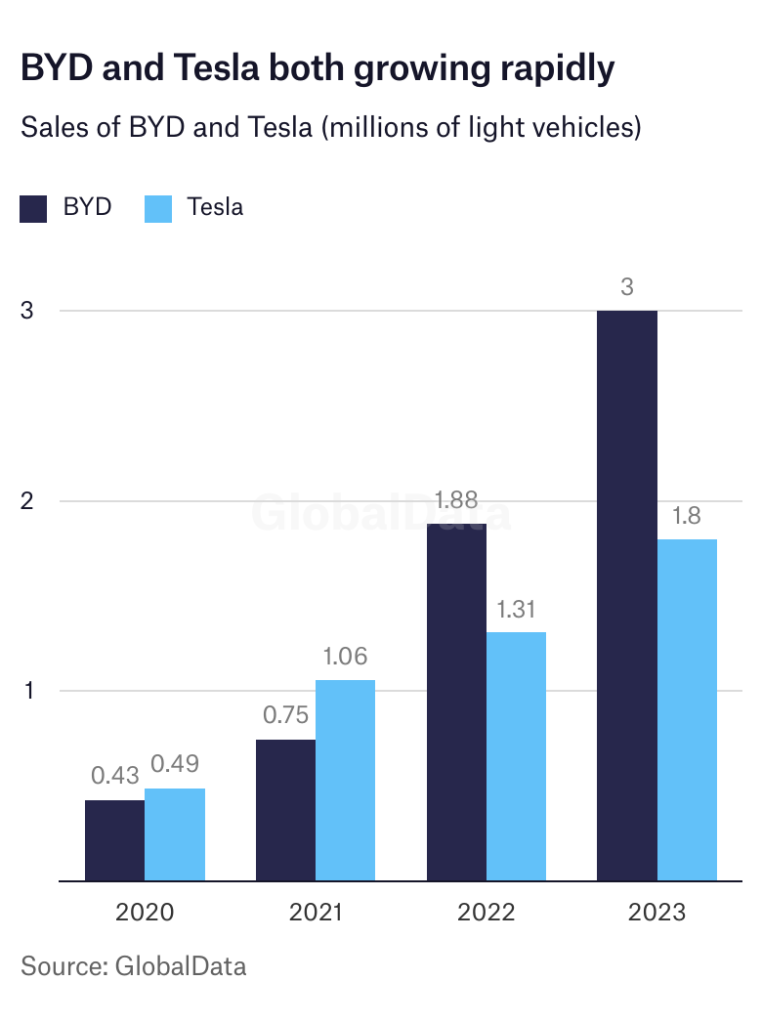

More worryingly for Tesla, the Chinese OEMs massively raised their BEV game just as Shanghai’s output came on stream. That caused Tesla to slash prices in China and led to a more generalised price war that the Chinese OEMs always seemed extremely well placed for with their competitively priced smaller cars. BYD, in particular, has emerged as a major competitor for Tesla, but the Chinese market has also been flooded with BEV products from others such as Chery, SAIC and Great Wall Motor (GWM). The volatile competitive landscape there has yet to play out.

Also in the Tesla deficit column, there have been real safety concerns surrounding the Tesla ‘Autopilot’ system and the apparent exaggeration of claimed ‘full self-driving capabilities’. On that subject, Tesla has stuck stubbornly to using machine vision systems (or cameras) to help its cars navigate the world. Others have adopted a multi-sensor approach that includes LiDAR and radar. Of course, it could be that Tesla has camera-based systems that perform at least as well as multi-sensor alternatives, but it has left Tesla open to accusations of being out-of-step with industry best practice. Watch that space as self-driving capabilities rise and more ADAS features are rolled out across the industry.

So, Tesla has been subject to some less than positive press over the past few years.

Against that, it’s perhaps worth just taking stock of where Tesla is today. First off, it’s a brand that is very well liked by many. Like Apple, it helps that there are attractive and distinctive product designs that have been generally well-received. The signature huge LCD screen in the central binnacle of the dashboard provides a surprise and delight factor for UX that distracts from the otherwise low-cost interior feel. Clever packaging and design that is no accident. Tesla has pioneered OTA updates and is perceived by many to be a tech company rather than a more traditional automotive company that is heavy with old-style engineering attributes and factories.

Tesla has also led the BEV industry in making provision for fast-charging infrastructure for its customers.

Second, while Tesla does now face more competition – not least in China – it is nevertheless in a strong market position. The Model Y continues to be a very strong seller in the US and Europe, where it leads burgeoning electric car segments. Right now, all in the segment are being negatively impacted by a softening of demand for BEVs, but the long-term outlook for BEVs sales remains highly positive. Some fragmenting of the growing global BEV market was always going to be inevitable, but Tesla faces that from a position of strength with its major share segment slice.

Tesla also has a spread of sales in major world markets that major competitor BYD lacks. BYD is aiming to crack Western Europe, but Tesla already has. There is a lot for BYD to do and there are some question-marks there – not least in the threat of EU price tariffs (pending an EU Commission investigation into alleged Chinese anti-competitive practices). Potential is a good thing to have, but it has yet to be realised in terms of branding and developing retail networks across the region. BYD is also not present in North America and that territory will stay problematic for Chinese OEMs while political tensions and uncertainties persist in US-China relations.

Tesla’s global expansion strategy now relies heavily on China where its Shanghai plant increased production 33% to 947,000 Model 3s and Ys last year, accounting for more than half of its global vehicle output. Of these, 600,000 were for sale locally. India will likely be the location for Tesla’s next plant.

If the 20 million a year ambition for Tesla sales by 2030 looks rather ambitious, it is nevertheless clear that Tesla is achieving impressive growth. In 2023, Tesla hit 1.8 million sales globally – 38% ahead of the previous year – an impressive result given where it has come from. A slowdown in Tesla sales growth is realistic given where overall BEV demand – sluggish – is likely to be in 2024 and where ramp-up in China sits. So Tesla is a major global automotive OEM, even if its level of output is still dwarfed by the likes of Toyota and General Motors.

The share price and investor sentiment? It appears that expectations are coming more into line with reality. The Tesla share price has fallen by more than half since its high-water mark in November 2021. Nevertheless, Tesla’s market capitalisation still tops the sector by a huge margin. It is over twice that of second placed Toyota and over ten times that of General Motors.

Some of the sheen may have come off the Tesla brand compared with sentiment a few years ago, but expectations are arguably being sensibly realigned. The Tesla brand is nevertheless in a strong position in a part of the global automotive market that is growing fast. It is not encumbered by the ‘legacy issues’ that the established players face in terms of transforming their existing manufacturing operations for BEVs. Also, other relative newcomers to the world stage – such as BYD – will face major challenges ahead.

Tesla is different from the rest. That can be something of a double-edged sword, but Tesla’s operating margin is still way ahead of the auto industry average. It faces the challenges ahead from a position of considerable strength.

Related Company Profiles

Tesla Inc

Toyo Tanso Co Ltd

General Motors Co

BYD Co Ltd

SAIC Motor Corp Ltd